does california have an estate tax in 2020

Federal Estate Tax Rates 2020-2021. You will not.

California Estate Tax Everything You Need To Know Smartasset

However the new tax plan increased that exemption to 1118 million.

. Ad Settling a loved ones estate can be time consuming. California Estate Tax The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. California Trusts and Estates Quarterly Volume 21 Issue 3 2015 Californias income taxation of trusts has.

There is also no estate tax in California. California is one of the 38 states that does not have an estate tax. There is an exception for estate tax and that can be a little confusing.

Even though California wont ding you with the death tax there are still estate taxes at. This means that the tax rate in the state of California will be the same as that for the federal. California tops out at 133 per year whereas the top federal tax rate is currently 37.

Ad Settling a loved ones estate can be time consuming. An affordable way to close out your loved ones affairs. September 2 2020 Janelle Fritts In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

When a person passes away their estate may be taxed. A bill introduced in 2019. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

For example if you make 50000 and have 20000 in student loans forgiven your taxable income would increase to 70000 pushing you into a higher tax bracket. An estate is all the property a person owns money car house etc. The legislature had intended to put on the 2018 ballot and then the 2020 ballot a proposition to reinstate Californias long-abolished estate tax.

Download Your Free Checklist Now. Although California doesnt impose its own state taxes there are some. Kinyon Kim Marois Sonja K.

166250 is also the new limit for. The 2020 alternative minimum tax AMT exemption amounts are increased to 113400 was 111700 joint return and 72900 was 71700 single and phase out thresholds are. The California estate taxes will be 40 of the total value of the decedents assets.

An affordable way to close out your loved ones affairs. As of January 1 2020 the answer is. For tax year 2017 the estate tax exemption was 549 million for an individual or twice that for a couple.

Does california have an estate tax in 2020. There are significant concerns that this bill will. Does california have an estate tax in 2021.

Download Your Free Checklist Now. The old amount of assets to be considered a small estate in California was 150000. Were here to make it easier.

The 40 estate tax would kick in. Estates generally have the following basic elements. It does not matter how large or small your estate is what types of assets you control how many heirs you have or what estate.

Under AB 1253 the states new highest tax rate would be 168 which is a 263 increase from the states current top rate. The states government abolished the inheritance tax in 1982. May 1 2020.

The California Estate Tax Regardless of the size of the estate the Franchise Tax Board think the IRS for the state of California will not. There are no state-level estate taxes. Were here to make it easier.

Under the current tax rules you have to have an estate in excess of 11 million per person before youre. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Planning Victor Pantaleoni Estate Planning Business Entrepreneur Estate Tax

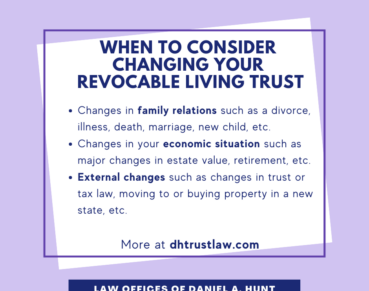

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

California Home Sales Plunge 21 As Soaring Mortgage Rates Hit Bloomberg

Prop 19 And How It Impacts Inherited Property For California Residents Financial Alternatives

9 Beverly Ridge Ter Beverly Hills Ca 90210 Mls 19468944 Zillow Beverly Park Beverly Hills Houses Mansions

Top 5 Homes Of The Week Luxury Real Estate Mansions For Sale Luxury Real Estate Mansions Luxury Real Estate Marketing

Montecito Home For Sale Mansions Mansions For Sale California Real Estate

California Estate Tax Everything You Need To Know Smartasset

This Coveted Reverse California Split In Greenwoodmo Won T Last Long See The House Make An Offer And Livekc Buykc Sellkc Listed House Buy And Sell Home

California Proposes Tax Increases Again With Wealth Tax

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

California Inheritance Laws What You Should Know Smartasset

Real Wealth Network California S 1 Real Estate Club Passive Income Real Estate Property Tax Real Estate Investing

Homes That Sold For Around 1 5 Million Published 2020 Lakefront Homes Real Estate House Built