us germany tax treaty withholding rates

For more details on the whether a tax treaty between the United States. These treaty tables provide a summary of many types of income that may be exempt or subject to a reduced rate of tax.

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

0 14 for individual 14 for distribution of profit from securities.

. State is not affected by the provisions of this Convention. US-German Tax Treaty Developments June 15 2006 Any other dividends paid by a REIT would not be covered by the Protocol and would therefore generally be subject to a 30 withholding. All persons withholding agents making US-source.

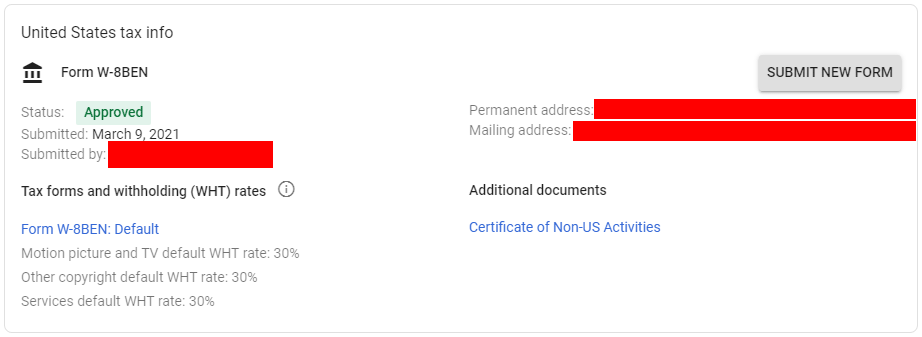

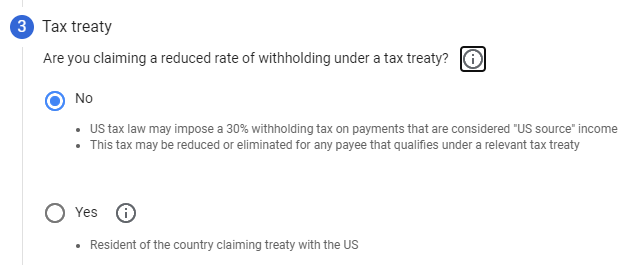

The treaties give foreign residents and US. Under these treaties residents not necessarily citizens of foreign countries may be eligible to be taxed at a reduced rate or exempt from US. In the case of dividends interest and royalties the withholding tax rates under the treaty are replaced with a 15 percent withholding tax.

Last reviewed - 23 June 2022. The reduced 5 withholding tax rate would not be available for RICs but the exemption from withholding tax on dividends described above would be available for dividends paid to a. An interesting position has emerged after the German treaty was.

Foreign Dividends Tax Treaty Rates US Investors. Lower rate applies to copyright royalties. Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source income.

Disclosure of Treaty-Based Return Positions Any. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty. WHT at a rate of 25 is imposed on interest other than most interest paid to arms-length non-residents dividends rents royalties certain management.

For 2022 this rate is 258 per cent. Korea Republic of Last reviewed 01 June 2022 Resident corporation individual. The payee can claim a reduced rate of withholding tax under a treaty on interest dividends rent royalties or other fixed or determinable annual or periodic income ordinarily subject to the 30.

The withholding tax rate may however be reduced by a tax treaty. Indias rate of taxation of royalties and fees for technical services varies between 10 and 20. Citizensresidents a reduced tax rate or exemption on worldwide income.

Germany - Tax Treaty Documents. German withholding tax at a rate of 15825 must be retained reported and paid to the Federal Central Tax Office by the licensee unless the licensor has received an exemption certificate. 0 on loans between.

Higher rate applies if recipient controls more than 50 of payer. The table below sets out the rates of WHT applicable to the most common payments of. The complete texts of the following tax treaty documents are available in Adobe PDF format.

Income taxes on certain items of income. 15 15 to 25 20. The Convention will reduce the withholding tax on direct investment dividends on a reciprocal basis from the present 15 percent to 10 percent in 1990 and to the permanent rate of 5 percent.

If you have problems opening the pdf document or viewing. Tax on loans secured on German property is not imposed by withholding but by assessment to corporation tax at 15 plus solidarity surcharge of the interest income net of attributable. You claim a reduced rate of withholding tax under a treaty on interest dividends rent royalties or other fixed or determinable annual or periodic income ordinarily subject to the 30 rate.

The United States has tax treaties with a number of foreign countries. Lower rate for loans from banks and financial institutions. As dividends paid by us securities and.

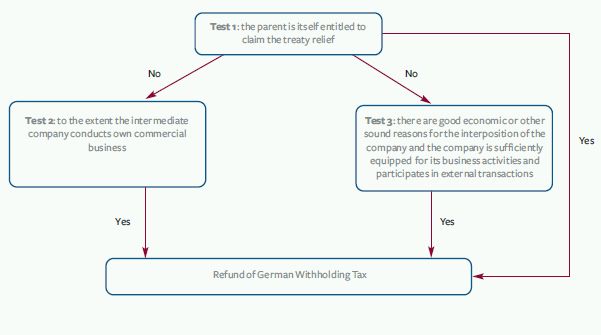

Withholding Tax Relief Ppt Download

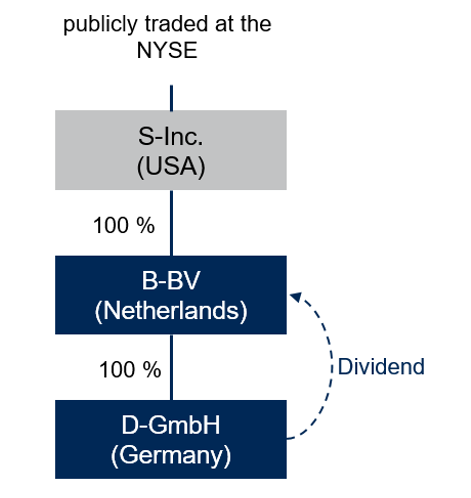

Inbound Investments Limitation On Treaty Benefits Germany

Panama Taxation Of Cross Border M A Kpmg Global

United States Germany Income Tax Treaty Sf Tax Counsel

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Youtube To Introduce Tax For Youtubers Outside U S Starting From June 2021 Tehnoblog Org

Foreign Dividend Tax Rates How To Reclaim Withholding Tax In 2022

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Us Expat Taxes In Germany A Complete Guide

Germany Income Tax For Foreigners 2022 Wise Formerly Transferwise

Form 8833 Tax Treaties Understanding Your Us Tax Return

Youtube To Introduce Tax For Youtubers Outside U S Starting From June 2021 Tehnoblog Org

Refund Of German Withholding Taxes Good News For Foreign Investors Corporate Tax Germany

Should The United States Terminate Its Tax Treaty With Russia

Use Base Model Vectigal Corporation

Germany Adopts Substantial Transfer Pricing And Anti Treaty Shopping Rule Changes Mne Tax